Are you ready to transform your relationship with money and achieve financial freedom? Picture a life where debt is a thing of the past, mindfulness guides your spending habits, and wealth-building becomes second nature. Vicki Robin‘s groundbreaking book, “Your Money or Your Life,” offers a roadmap to achieve just that. Say goodbye to financial stress and say hello to a more intentional, abundant way of living. Let’s dive into some of the transformative concepts from this empowering read!

Key Idea No. 1: Know Your “Enough”

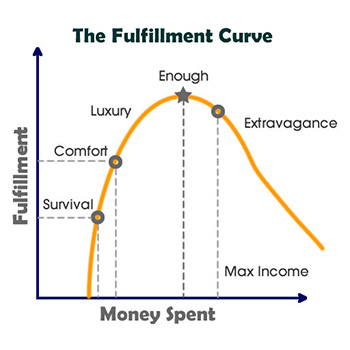

In today’s consumer-driven world, the concept of “enough” often gets lost in the constant pursuit of more. But have you ever stopped to consider what “enough” really means, especially when it comes to our finances?

Understanding where we draw the line on what’s “enough” is super important, whether it’s about money or other parts of our lives. Nobel prize-winning economist Daniel Kahneman in his research found that there’s a limit to how much money can make us happy.

So, what does this mean for us? It means we need to define our own version of “enough” in various aspects of our lives, particularly in our financial decisions. It’s about finding that sweet spot where we feel content and fulfilled without constantly chasing after more.

Instead of solely focusing on amassing wealth, we should prioritize fulfillment. Ask yourself: What truly brings me joy and satisfaction? Is it the latest gadgets or experiences shared with loved ones? By shifting our mindset to prioritize fulfillment over mere accumulation, we can make more intentional choices with our money.

Next time you’re tempted to make a purchase, pause and reflect: Is this adding genuine value to my life, or am I simply feeding into the never-ending cycle of wanting more? Remember, true fulfillment doesn’t come from material possessions alone but from living a life aligned with our values and passions.

Key Idea No. 2: Calculate Your Net Worth

Understanding your financial journey is crucial for gaining control over your money and achieving financial freedom. Most people have no clue about the total sum of money they’ve dealt with in their lives. Crazy, right? But knowing this stuff can change the game for you.

Let’s break it down. First things first, you need to tally up every single cent you’ve earned from your very first job to your latest hustle.

Once you’ve got that number, it’s time to check out your net worth. Basically, this means adding up everything you own (your assets) and subtracting everything you owe (your liabilities).

Assets are things you’ve got that you could turn into cash, like money in your bank account, stocks, or even that spare change in your car. It also includes things you own, big or small, that you could sell.

Then there are liabilities, which are basically what you owe, like debts or bills. Subtract what you owe from what you own, and you’ve got your net worth.

But we’re not done yet! Now it’s time to figure out your real hourly wage. This isn’t just about what you earn at work. It’s about factoring in all the hours you put in, plus the costs related to your job, like commuting or buying lunch.

Why go through all this effort? Because it gives you a clear picture of how much your time is actually worth. And that’s super helpful for making smarter decisions about your money.

Sure, it might seem like a bit of a chore, but it’s totally worth it. When you know where your money is going, you can make choices that really align with what matters most to you.

Armed with this knowledge, you can start directing your money towards the things that truly light you up – whether it’s hanging out with friends, chasing your dreams, or investing in yourself. The possibilities are endless!

Key Idea No. 3: Cut Your Spending

Once you’ve got a grip on your net worth and know how much you’re earning per hour, it’s time to get smart about spending. It’s not always easy, but with a bit of effort, you can slash those unnecessary expenses.

Start by taking a good hard look at where your money’s going. Check out your spending habits. Are there areas where you’re splurging unnecessarily? Maybe you’ve got subscriptions you’re not even using. Time to cut those loose.

Next, practice mindfulness when making purchasing decisions. Before buying something, ask yourself if it’s a genuine need or just a passing want. Learning to distinguish between the two can help you prioritize your spending and avoid impulse purchases.

Additionally, consider the value of quality over quantity. While opting for cheaper alternatives may seem tempting, investing in higher-quality items can save you money in the long run by lasting longer and requiring fewer replacements.

By embracing frugality, you’ll free up resources to pursue your passions and long-term goals. Whether it’s saving for a dream vacation, starting a business, or building a comfortable retirement fund, frugality can help you achieve financial freedom.

Key Idea No. 4: Value Your Life Energy

During the Industrial Revolution, workers fought for shorter hours amidst harsh conditions. Back then, the 40-hour workweek emerged not as a random number but as a result of their struggle. But why does this history lesson matter today?

The thing is, each hour we spend at work isn’t just about the paycheck – it’s about trading our time for money. So, let’s ask ourselves: is it really worth it?

In today’s world, it might seem like we need to grind away for 40 hours to be considered valuable. But let’s be honest – most of us work to earn a living. Sure, we might enjoy our job or make some friends along the way, but ultimately, it’s about the cash.

If financial freedom is your goal, then it’s all about recognizing the value of your time and finding ways to boost your income. So, ask yourself: Is the effort you’re putting into your job really paying off? Are you getting enough in return for your hard work?

Your most valuable asset? It’s your time and energy. Once you’ve spent it, there’s no getting it back. So, every hour you work is essentially a trade-off for money. Ever thought about how much your purchases really cost you in terms of your life energy? For example, if you’re making $4.5 an hour, splurging on a new car could mean sacrificing 772 days of work! That’s a lot of life energy gone into one purchase.

To get a handle on where your energy is going, try tracking your spending for a month. Ask yourself: Did that purchase bring me the satisfaction I expected? Does it align with my values? And how would my spending habits change if I didn’t have to work so hard for cash?

By aligning your expenses with what truly matters to you, you pave the way towards financial freedom. So, take control of your life energy, reassess your priorities, and start making choices that lead to a more fulfilling future.

Key Idea No. 5: Put Your Money into Use for Financial Freedom

Achieving financial freedom is like embarking on an exciting journey. It starts with making smart investment choices and planning ahead.

One crucial step towards financial freedom is building an emergency fund. Start by setting aside funds equivalent to at least six months of living expenses. This safety net will provide security during unexpected setbacks, allowing you to stay on track with your long-term goals.

Once you’ve nailed down your emergency fund, it’s time to level up. Get ready to dive into the world of investing and keep a sharp eye on your savings. The goal? Spotting opportunities to grow your wealth wisely and strategically. And here’s a tip: patience and attention to detail are your secret weapons in this game.

Sure, your investment income might start off small, but it’ll snowball over time as your portfolio blossoms. So, even if you don’t see instant results, stick to the plan. Trust that your efforts will pay off in the long run.

“Your Money or Your Life” by Vicki Robin serves as a powerful guide to financial freedom, offering a roadmap to reshape our money mindset and take control of our lives. This book’s principles empower us to manage money wisely, reduce unnecessary expenses, and invest in our future selves.

To embark on your journey to financial freedom, click here to start transforming your relationship with money today!

Leave a Reply